Easily examine equity and option execution quality using exception reporting with a wide variety of customizable metrics and benchmarks.

S3’s Best Execution Analysis tool streamlines your review of execution quality using exception-based reporting in an easy-to-use web-based platform. The S3 portal’s intuitive navigation allows you to take a holistic view of your data, or quickly drill into a single trade, using multiple data points for analysis. The favorites feature allows you to create and save exception reports that can be delivered directly to your inbox on a regular basis. The audit trail function manages trade exceptions between multiple teams, and can be customized to suit your procedures so you can maintain records directly in the portal.

605 and 606 Analysis

Compare and analyze public 605 and 606 reports submitted across the industry to see how your trades could have executed elsewhere

Extended Hours Trading

Review extended hours trading activity and maintain consistency across best ex analyses using the same metrics and benchmarks

24/5 Best Execution Analytics

S3 has partnered with Blue Ocean Technologies, LLC to receive 24/5 market data, enabling you to apply our unrivaled best execution analytics to executions that occur outside of market hours.

FX Aware

The FX-Aware Best Ex tool allows you to determine in which market you will achieve best execution when making cross-border trading decisions. The tool uses the exact exchange rate available at the time of order placement and trade, along with the price of execution in either currency, comparing the execution to the market available in both countries. The tool compares each real execution against a theoretical execution for an equivalent trade in the other market, using the FX rate available to the customer at order and trade time. FX-Aware Best Ex works with any equivalent security, including dual-listed, interlisted, ADRs, and over-the-counter secondary listings.

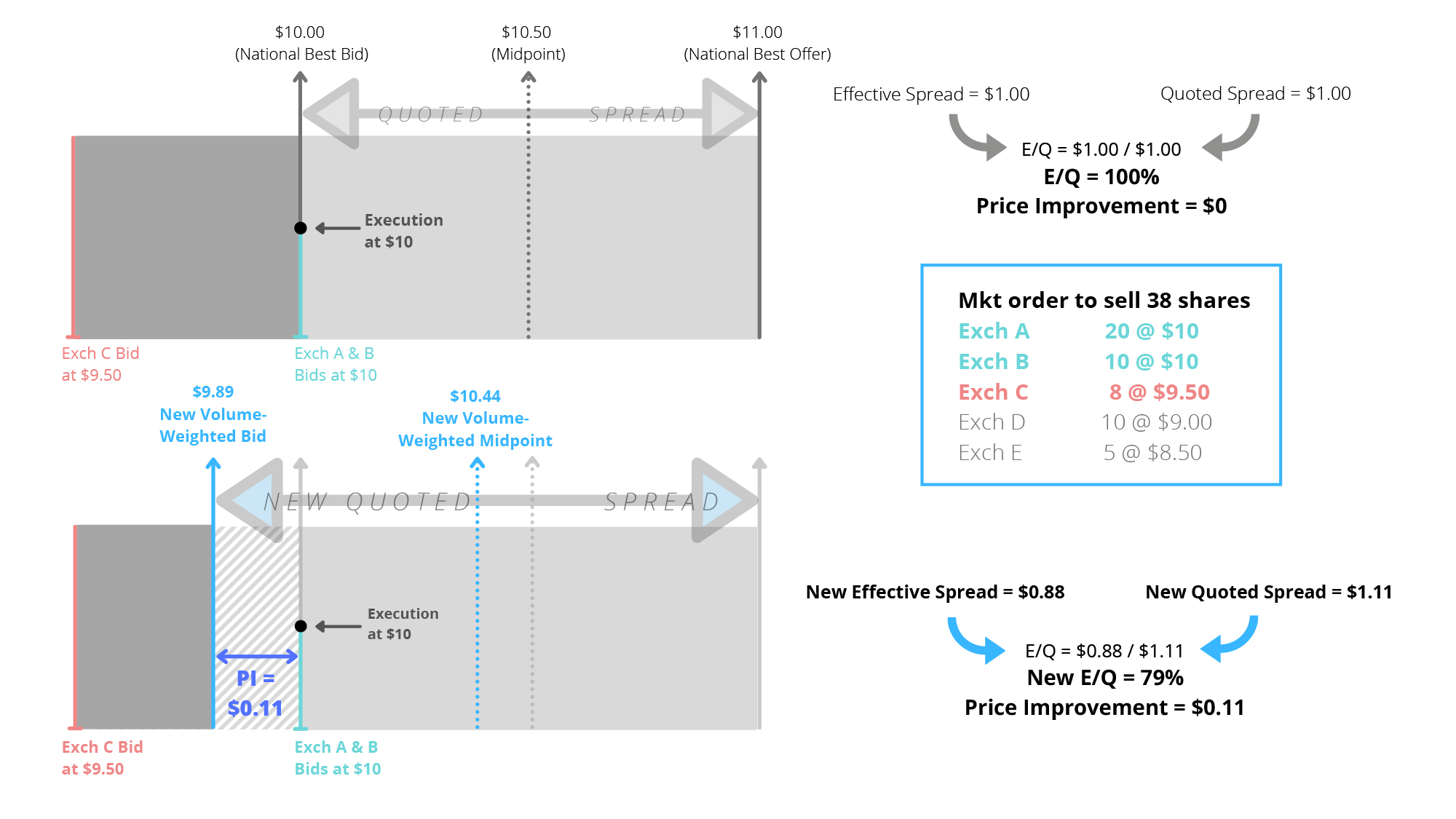

Depth Aware Enhanced EQ

Instead of using the NBBO to determine price improvement or execution quality, our Depth Aware Enhanced E/Q tool looks at the full volume available at the top of book at each exchange and creates a ‘volume-weighted bid or offer (BBO)’ that considers the order size at each price level. The result is an E/Q that more closely reflects the true execution quality – rather than a comparison to a quoted spread that doesn’t move with the market – and a clearer representation of price improvement.

OTC Depth Aware

S3’s new OTC Depth Aware tool provides a more precise picture of execution quality being delivered on OTC securities. The tool generates a volume-weighted price based on the depth of quotes from each market maker at the time of order placement for the full volume of the order. That volume-weighted price is then used to determine stats such as “Depth Price Improvement” and “Depth EQ.” While this methodology isn’t meant to replace the current process, it can help users gain a more precise understanding of what is happening in the market, which is particularly useful when it comes to OTC securities.

OTC Best Execution Analysis

The OTC Best Ex tool uses “depth EQ” which considers whether there is adequate liquidity at the time of order placement, with quoted and effective spreads notionally weighted by execution volume. It also excludes partial executions, locked and crossed orders, orders where the bid is less than a penny, orders where the volume is greater than 25% of ADV, and many other particulars about OTC that would otherwise drastically skew your EQ.